Back to all Articles

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

How to Approach Embedded Payments Software Development

Updated:

Fri, Jan 30

Reading time: 10 minutes

Embedded payments are essential for businesses looking to simplify transactions, improve customer experiences, and grow revenue.

Whether you run an online store, offer software services, or manage a marketplace, custom embedded payment systems can give your business a competitive edge.

In this article, you'll learn about embedded payments software development and how to start.

Whether you run an online store, offer software services, or manage a marketplace, custom embedded payment systems can give your business a competitive edge.

In this article, you'll learn about embedded payments software development and how to start.

What Are Embedded Payments?

Embedded payments are a seamless, API-driven payment integration within non-financial platforms, allowing users to complete transactions without leaving the application or service they are using. By embedding payment processing directly into software, marketplaces, and digital services, businesses eliminate friction, improve user experience, and streamline checkout flows.

Embedded payments make it easy for customers to pay directly within a company’s platform, software, or app. This removes the need to visit third-party sites or payment portals, creating a smoother checkout experience.

Businesses use embedded payments to let users complete purchases without leaving their system. It’s a popular solution in industries like e-commerce, fintech, and software platforms. Embedded payments support credit cards, digital wallets, and bank transfers, so customers have flexible options.

By implementing embedded payments, companies can streamline transactions, reduce operational hurdles, and boost revenue.

Businesses use embedded payments to let users complete purchases without leaving their system. It’s a popular solution in industries like e-commerce, fintech, and software platforms. Embedded payments support credit cards, digital wallets, and bank transfers, so customers have flexible options.

By implementing embedded payments, companies can streamline transactions, reduce operational hurdles, and boost revenue.

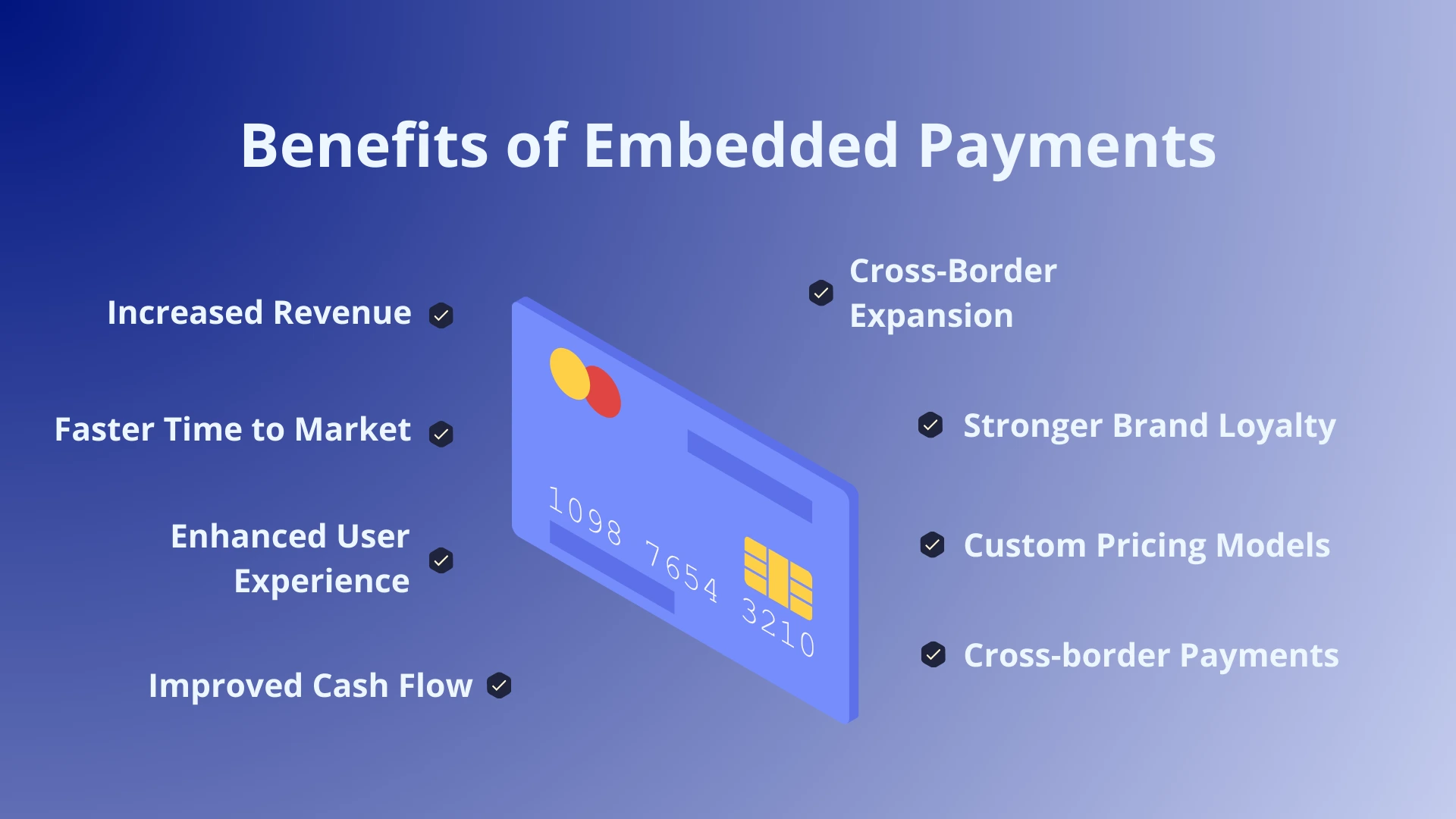

Key Benefits of Embedded Payments

Embedded payments offer many advantages for businesses and customers. The biggest benefit is a faster and easier checkout process. This reduces friction and keeps customers happy. As a result, it often leads to higher sales and fewer abandoned carts.

Businesses can also gain insights into payment data and personalize services afterward. Embedded payments reduce costs by eliminating the need for third-party gateways.

To sum up:

Businesses can also gain insights into payment data and personalize services afterward. Embedded payments reduce costs by eliminating the need for third-party gateways.

To sum up:

- Improved User Experience: Transactions occur natively within the platform, reducing friction.

- Increased Conversion Rates: Fewer steps mean fewer drop-offs during checkout.

- Revenue Growth: Monetize transactions through processing fees or value-added services.

- Enhanced Brand Loyalty: Customers appreciate the convenience of integrated payments.

What Industries Benefit Most from Embedded Payments?

Embedded software is used in various industries. Many businesses see huge benefits from using embedded payments. E-commerce platforms use them to make checkout faster, boosting sales and reducing abandoned carts.

Healthcare companies streamline billing and offer secure, easy payments for medical services. In travel, embedded payments let users book flights, hotels, or rentals within one platform without hassle.

Subscription-based businesses, like streaming services, also gain from this approach. Embedded payments ensure recurring charges happen smoothly, so users enjoy uninterrupted access. Fintech startups also benefit by improving customer engagement and adding valuable services.

Read the top 9 embedded finance examples to explore real-world use cases.

Healthcare companies streamline billing and offer secure, easy payments for medical services. In travel, embedded payments let users book flights, hotels, or rentals within one platform without hassle.

Subscription-based businesses, like streaming services, also gain from this approach. Embedded payments ensure recurring charges happen smoothly, so users enjoy uninterrupted access. Fintech startups also benefit by improving customer engagement and adding valuable services.

Read the top 9 embedded finance examples to explore real-world use cases.

Why Choose Custom Embedded Payments Software Development?

Let’s face it—off-the-shelf payment solutions don’t always fit your business needs. That’s where tailored embedded payment software development shines. Imagine you’re running an e-commerce platform, a SaaS company, or a marketplace, and you’re frustrated with the limitations of standard payment systems. Probably they don’t support the payment methods your customers prefer, or they lack the flexibility to integrate with your existing tools.

At Ulan Software, we know these challenges and help businesses like yours overcome them with tailor-made solutions.

When you opt for custom development, you get a payment system designed specifically for your business. It’s like having a suit tailored to fit you perfectly—it feels right, works better, and leaves a great impression on your customers.

But it’s not just about speed. Custom solutions let you integrate payment features directly into your app or website. This means no redirects to external portals, which often lead to cart abandonment. Everything happens in one seamless flow, boosting customer trust and satisfaction. Plus, you can include advanced features like split payments, recurring billing, or even loyalty rewards, depending on your business needs.

At Ulan Software, we also understand how important security is when it comes to payments. With a custom system, you can ensure the highest level of data protection with tools like encryption, tokenization, and compliance with regulations like PCI DSS.

One of our clients in the healthcare industry needed a secure way to process sensitive patient payments online. We built a solution that met all industry standards while providing a user-friendly interface. They now process transactions more securely and efficiently than ever.

Another reason to go custom is the power of scalability. Off-the-shelf solutions can hold you back when your business starts growing or entering new markets. With a custom embedded payment system, you can easily add features, integrate with local payment methods, or handle increased transaction volumes without a hitch.

For example, we recently helped a growing subscription-based platform expand into multiple countries. Their custom system now supports local currencies and payment options for each region, giving them a major edge over competitors.

Finally, let’s talk about control. A custom solution means you own the code and can adapt it as your business evolves. No more relying on a third-party provider’s roadmap or paying for unnecessary features you’ll never use. This gives you more freedom to innovate and stay ahead in your industry.

So, if you’re tired of one-size-fits-all solutions, custom embedded payment software development is the way to go. At Ulan Software, we’ve built solutions for businesses across industries, and we know how to create payment systems that deliver real results. Let’s build something that works for your business, not everyone else’s.

At Ulan Software, we know these challenges and help businesses like yours overcome them with tailor-made solutions.

When you opt for custom development, you get a payment system designed specifically for your business. It’s like having a suit tailored to fit you perfectly—it feels right, works better, and leaves a great impression on your customers.

But it’s not just about speed. Custom solutions let you integrate payment features directly into your app or website. This means no redirects to external portals, which often lead to cart abandonment. Everything happens in one seamless flow, boosting customer trust and satisfaction. Plus, you can include advanced features like split payments, recurring billing, or even loyalty rewards, depending on your business needs.

At Ulan Software, we also understand how important security is when it comes to payments. With a custom system, you can ensure the highest level of data protection with tools like encryption, tokenization, and compliance with regulations like PCI DSS.

One of our clients in the healthcare industry needed a secure way to process sensitive patient payments online. We built a solution that met all industry standards while providing a user-friendly interface. They now process transactions more securely and efficiently than ever.

Another reason to go custom is the power of scalability. Off-the-shelf solutions can hold you back when your business starts growing or entering new markets. With a custom embedded payment system, you can easily add features, integrate with local payment methods, or handle increased transaction volumes without a hitch.

For example, we recently helped a growing subscription-based platform expand into multiple countries. Their custom system now supports local currencies and payment options for each region, giving them a major edge over competitors.

Finally, let’s talk about control. A custom solution means you own the code and can adapt it as your business evolves. No more relying on a third-party provider’s roadmap or paying for unnecessary features you’ll never use. This gives you more freedom to innovate and stay ahead in your industry.

So, if you’re tired of one-size-fits-all solutions, custom embedded payment software development is the way to go. At Ulan Software, we’ve built solutions for businesses across industries, and we know how to create payment systems that deliver real results. Let’s build something that works for your business, not everyone else’s.

Key Features of Embedded Payment Solutions

When we talk about embedded payment solutions, it’s not just about processing payments—it’s about making the entire experience smooth, efficient, and user-friendly.

Whether you're running an e-commerce platform, a SaaS business, or a marketplace, the right features can make all the difference.

At Ulan Software, we build custom embedded payment systems that not only meet but exceed expectations, and here’s what are the key features you should look for.

Whether you're running an e-commerce platform, a SaaS business, or a marketplace, the right features can make all the difference.

At Ulan Software, we build custom embedded payment systems that not only meet but exceed expectations, and here’s what are the key features you should look for.

1. API-Driven Architecture

At the core of any modern payment solution is an API-driven architecture. Why? Because it allows flexibility and easy integration with your existing systems. APIs enable to connect with multiple payment gateways, support custom workflows, and scale as your business grows.

2. Seamless Integration

Imagine you’re shopping online, and just as you're about to pay, you’re redirected to another website. It’s annoying, right?

Embedded payment solutions eliminate this problem. They allow payments to happen directly within your app or platform, keeping users in a familiar environment.

For one of our clients, we integrated payments into their existing system so smoothly that their customers didn’t even realize a third party was involved.

Embedded payment solutions eliminate this problem. They allow payments to happen directly within your app or platform, keeping users in a familiar environment.

For one of our clients, we integrated payments into their existing system so smoothly that their customers didn’t even realize a third party was involved.

3. Multiple Payment Options

Not everyone pays the same way. Some prefer credit cards, others like digital wallets, and some want to transfer money directly from their bank accounts. An embedded payment solution should offer flexibility to cater to all these preferences.

When we worked with a subscription-based SaaS platform, we included options like Apple Pay, Google Pay, and recurring billing, which made it easier for their global audience to subscribe without hassle.

When we worked with a subscription-based SaaS platform, we included options like Apple Pay, Google Pay, and recurring billing, which made it easier for their global audience to subscribe without hassle.

4. Advanced Security Measures

Payments involve sensitive data, so security is non-negotiable. Features like encryption, tokenization, and fraud detection are essential to protect your customers and your business.

At Ulan Software, we specialize in building systems that comply with industry standards like PCI DSS. For example, we developed a secure payment solution for a healthcare client, ensuring that patient payments were processed safely while staying compliant with regulations.

At Ulan Software, we specialize in building systems that comply with industry standards like PCI DSS. For example, we developed a secure payment solution for a healthcare client, ensuring that patient payments were processed safely while staying compliant with regulations.

5. Recurring Payments and Subscriptions

If your business model relies on subscriptions, recurring payments are a must. Embedded payment solutions can handle this seamlessly, automating the process so your customers don’t have to manually renew every month.

We helped a fitness app integrate recurring billing with reminders, making it easier for users to maintain their subscriptions—and for the business to keep consistent revenue.

We helped a fitness app integrate recurring billing with reminders, making it easier for users to maintain their subscriptions—and for the business to keep consistent revenue.

6. Real-Time Analytics

Want to know how your payment system is performing? Real-time analytics gives you insights into transaction volumes, customer behavior, and revenue trends.

We recently built a dashboard for a marketplace client that allowed them to monitor payments in real time, helping them make faster, data-driven decisions.

We recently built a dashboard for a marketplace client that allowed them to monitor payments in real time, helping them make faster, data-driven decisions.

7. Scalability

Your business might start small, but it’s going to grow. A good embedded payment solution is scalable, meaning it can handle more users, transactions, and features as you expand. We’ve built systems for businesses that later scaled to handle thousands of daily transactions without a hitch.

8. Customization

Finally, one size doesn’t fit all. Your payment solution should match your branding and meet your specific needs. At Ulan Software, we prioritize creating solutions that feel like a natural part of your platform.

The Embedded Payment Solution Development Process

Building an embedded payment solution isn’t just about writing code—it’s about creating a seamless system tailored to your business needs.

At Ulan Software, we’ve gone on this journey with clients across industries. Our process ensures you get a solution that works perfectly for your platform. Let us walk you through how it works.

At Ulan Software, we’ve gone on this journey with clients across industries. Our process ensures you get a solution that works perfectly for your platform. Let us walk you through how it works.

1. Understanding Your Business Needs

It all starts with listening. We dive deep into understanding your business, your customers, and the pain points you’re facing with payments. Whether it’s a clunky checkout process, limited payment options, or a lack of control over data, we pinpoint the challenges.

For example, when we worked with an e-commerce platform, they needed a system that could handle high transaction volumes while integrating with their order management tool. This clear picture set the foundation for the project.Click edit, to change text...

For example, when we worked with an e-commerce platform, they needed a system that could handle high transaction volumes while integrating with their order management tool. This clear picture set the foundation for the project.Click edit, to change text...

2. Designing the Solution

Next, we design the architecture of your payment solution. This is where our expertise in API-driven architecture comes into play.

We map out how the system will integrate with your existing platform and decide on the features you need, like multi-currency support, recurring payments, or advanced analytics. The goal is to ensure the solution is scalable, secure, and future-ready.

At this stage, we also create wireframes or prototypes to give you a visual sense of how the payment flow will work. One client told us this step made the entire process feel real, helping them provide better feedback and refine the vision.

We map out how the system will integrate with your existing platform and decide on the features you need, like multi-currency support, recurring payments, or advanced analytics. The goal is to ensure the solution is scalable, secure, and future-ready.

At this stage, we also create wireframes or prototypes to give you a visual sense of how the payment flow will work. One client told us this step made the entire process feel real, helping them provide better feedback and refine the vision.

3. Building the Payment Solution

With the blueprint in place, our development team gets to work. This is where the magic happens. We use agile methodologies to ensure the solution is built in manageable phases, keeping you involved every step of the way. Our focus is on delivering clean, efficient code that integrates smoothly with your platform.

For instance, when working on a subscription-based SaaS platform, we developed the recurring billing feature first, testing it thoroughly before moving to analytics and reporting tools. This phased approach ensured the solution was stable and met their priorities.

For instance, when working on a subscription-based SaaS platform, we developed the recurring billing feature first, testing it thoroughly before moving to analytics and reporting tools. This phased approach ensured the solution was stable and met their priorities.

4. Testing and Optimization

Before launch, we test the system - both in simulated environments and live scenarios. This includes functionality, security, and performance testing to ensure the solution works flawlessly. If any issues arise, we fine-tune the system until it’s perfect

5. Deployment and Support

Once everything checks out, we roll out the payment solution. But we don’t stop there. Our team provides ongoing support to monitor performance, make updates, and scale the solution as your business grows.

For instance, after launching a payment solution for a growing marketplace, we helped them add new features like split payments and local currency support as their needs evolved.

Embedded payment solution development is a collaborative process, and at Ulan Software, we make sure you’re involved at every step. The result? A tailored system that improves your operations, delights your customers, and positions your business for success. Let’s build something great together!Click edit, to change text...

For instance, after launching a payment solution for a growing marketplace, we helped them add new features like split payments and local currency support as their needs evolved.

Embedded payment solution development is a collaborative process, and at Ulan Software, we make sure you’re involved at every step. The result? A tailored system that improves your operations, delights your customers, and positions your business for success. Let’s build something great together!Click edit, to change text...

Get Started Today

Ready to take your business to the next level with embedded payments software development?

Contact us now for a free consultation and discover how our tailored solutions can drive your success.

Contact us now for a free consultation and discover how our tailored solutions can drive your success.

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

Table of Contents:

What are embedded payments?

Why choose custom embedded payments software development?

Key features of embedded payment solutions

The embedded payment solution development process

Get started today

Recommended Articles

Wed, Feb 11

How to Build a Handyman Services Marketplace

Build a handyman services marketplace in 2026. Step-by-step guide: trends, features, business models, tech stack, and expert tips for founders and CTOs.

Fri, Jan 30

Why Big Brands Are Launching Second-Hand Recommerce Platforms?

Why big brands launch second-hand recommerce platforms. Examine real data, case studies, and results from IKEA, H&M, Zara, Zalando, and Decathlon.

Mon, Jan 26

How to Build Second-Hand Marketplace Platform Like Vinted? Part III: Strategy

Discover how Vinted built a scalable second-hand marketplace by sequencing growth, monetization, trust, and expansion the right way.