Back to all Articles

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

8 Examples of Green Banking Initiatives That Stand Out

Updated:

Wed, Jan 7

Reading time: 12 minutes

A global awareness about climate change and environmental responsibility is still growing. The role of banks in driving sustainable practices has come into sharper focus. Once seen only as financial institutions, many banks today are stepping up towards climate change. They’re adopting practices that prioritize the planet.

Green banking is no longer a buzzword; it’s a movement. It shows the commitment of financial institutions to reduce their carbon footprints. At the same time, they enable individuals, businesses, and communities to do the same.

Banks are looking for creative ways to make a positive impact and promote green banking. In this article, we’ll showcase 11 standout examples of green banking initiatives that might be inspiring for other banks as well. We will explore examples both from banks and neobanks.

Green banking is no longer a buzzword; it’s a movement. It shows the commitment of financial institutions to reduce their carbon footprints. At the same time, they enable individuals, businesses, and communities to do the same.

Banks are looking for creative ways to make a positive impact and promote green banking. In this article, we’ll showcase 11 standout examples of green banking initiatives that might be inspiring for other banks as well. We will explore examples both from banks and neobanks.

Why Green Banking is a Big Deal for Customers?

First, people are more aware of how their choices affect the planet. They don’t think about reducing plastic use or saving energy at home. Nowadays they also wonder what their money is doing when it’s sitting in a bank. Customers want to ensure their savings or investments aren’t funding fossil fuels or deforestation.

Second, many customers feel empowered to create positive change through their everyday actions. Choosing a green bank is an easy way to align their values with their money. It’s like saying, “I care about clean energy and sustainable projects, and I want my bank to care too.” Finally, banks focusing on sustainability often offer perks that appeal to modern lifestyles. For example, carbon tracking tools, rewards, and even help planting trees with every transaction. This makes banking seem less like a boring necessity and more like a way to contribute to a better future.

In short, customers care about green banking because it lets them use their money for good without sacrificing convenience or service quality. It’s a simple way to feel like they’re making a difference in the world.

Banks are picking up on the fact that people want more sustainable options. They’re coming up with cool tools and programs to help make that happen. For instance, some banks have carbon footprint trackers, so you can see how your spending affects the environment. Others even give you rewards (like cashback or discounts) for choosing eco-friendly habits. Here are the most impressive examples of Green Banking Initiatives.

Second, many customers feel empowered to create positive change through their everyday actions. Choosing a green bank is an easy way to align their values with their money. It’s like saying, “I care about clean energy and sustainable projects, and I want my bank to care too.” Finally, banks focusing on sustainability often offer perks that appeal to modern lifestyles. For example, carbon tracking tools, rewards, and even help planting trees with every transaction. This makes banking seem less like a boring necessity and more like a way to contribute to a better future.

In short, customers care about green banking because it lets them use their money for good without sacrificing convenience or service quality. It’s a simple way to feel like they’re making a difference in the world.

Banks are picking up on the fact that people want more sustainable options. They’re coming up with cool tools and programs to help make that happen. For instance, some banks have carbon footprint trackers, so you can see how your spending affects the environment. Others even give you rewards (like cashback or discounts) for choosing eco-friendly habits. Here are the most impressive examples of Green Banking Initiatives.

1. UmweltBank, Germany

UmweltBank is a German bank focused on environmentally sustainable banking. Since its founding in 1995, it has built a reputation for supporting projects that align with its green mission. UmweltBank uses its financial products exclusively to fund initiatives that benefit the environment.

UmweltBank is financing projects in areas like renewable energy, organic farming, and environmental conservation. It avoids investments in industries that negatively impact the environment ( i.e. fossil fuels or heavy industry). The bank creates tangible benefits for both the environment and local communities.

UmweltBank has financed thousands of solar energy projects and wind farms across Germany. By choosing UmweltBank, customers know that their deposits "work" to fund projects that contribute to a sustainable future.

UmweltBank is financing projects in areas like renewable energy, organic farming, and environmental conservation. It avoids investments in industries that negatively impact the environment ( i.e. fossil fuels or heavy industry). The bank creates tangible benefits for both the environment and local communities.

UmweltBank has financed thousands of solar energy projects and wind farms across Germany. By choosing UmweltBank, customers know that their deposits "work" to fund projects that contribute to a sustainable future.

UmweltBank’s clear focus on sustainability sets it apart from conventional banks. They follow a principle: supporting only those activities that benefit the planet. This attracts customers who want to align their financial activities with sustainability.

In practice, UmweltBank offers services similar to other banks. These are savings accounts, fixed deposits, and investment products—but with the added benefit. Customers know that these funds are actively supporting green initiatives. The bank regularly publishes detailed reports showing exactly how it uses customers’ money.

Over 27 years, it has financed more than 25,000 projects. In 2023, the bank's investments in wind, hydro, and solar power projects helped to avoid of approximately 1.3 million tons of CO₂ emissions. It is equal to the annual emissions of a city like Wolfsburg.

2. FutureCard, USA

Imagine a card that not only helps manage spending but supports efforts towards sustainable living. That’s FutureCard in a nutshell. It is a unique charge card designed for people who want to align their financial habits with sustainable friendly values.

The card's purpose is to encourage greener lifestyles by offering financial rewards for sustainable purchases. You can earn 5% cash back on categories like public transportation, electric vehicle charging, secondhand goods, and plant-based foods. That’s a pretty hefty incentive to make climate-conscious choices in daily life.

What sets FutureCard apart is its focus on rewarding sustainable behavior. Unlike other cards with generic reward categories, FutureCard dives deep into what makes a purchase environmentally friendly. From riding your bike to buying secondhand furniture or groceries with plant-based meat, you’re earning while doing good for the planet.

Another standout feature is its FutureScore. The app offers a personalized breakdown of your lifestyle’s environmental impact. It considers transportation habits, energy use, and shopping choices to provide insights on reducing carbon footprint.

But that’s not all. On the Future website, you’ll also find a dedicated Future Marketplace. It is a curated selection of sustainable goods and services packed with exclusive rewards. Whether you’re looking for secondhand gadgets or beauty products, this marketplace offers plenty of choices to help you shop more consciously.

3. Tomorrow, Bank Services, Germany

Tomorrow is a German bank committed to sustainable banking practices. It exclusively finances sustainable projects and companies. Every euro deposited with Tomorrow goes toward positive environmental and social initiatives, such as renewable energy, organic farming, and affordable housing projects.

The bank maintains full transparency about where customers' money goes through its "Impact Board,". It shows real-time data about the positive impact its banking activities create.

What makes Tomorrow different is how it turns routine banking activities into climate action. With every card payment, Tomorrow plants trees through verified reforestation projects. The bank calculates and offsets the CO2 emissions of each transaction, making everyday purchases climate-neutral.

They also offer a unique "Impact Sharing" feature. Half of the interchange fees from card transactions go to climate protection projects.

A standout feature on Tomorrow's website is their bank comparison tool. This tool allows directly compare Tomorrow's environmental and social performance against traditional banks using ESG criteria. Users can see how their current bank stacks up against Tomorrow in areas like climate action, sustainable investments, and social responsibility.

The bank maintains full transparency about where customers' money goes through its "Impact Board,". It shows real-time data about the positive impact its banking activities create.

What makes Tomorrow different is how it turns routine banking activities into climate action. With every card payment, Tomorrow plants trees through verified reforestation projects. The bank calculates and offsets the CO2 emissions of each transaction, making everyday purchases climate-neutral.

They also offer a unique "Impact Sharing" feature. Half of the interchange fees from card transactions go to climate protection projects.

A standout feature on Tomorrow's website is their bank comparison tool. This tool allows directly compare Tomorrow's environmental and social performance against traditional banks using ESG criteria. Users can see how their current bank stacks up against Tomorrow in areas like climate action, sustainable investments, and social responsibility.

4. VeloMarket by VeloBank, Poland

VeloBank created a solution for those who support environmental-friendly and sustainable lifestyles.

VeloMarket is a shopping platform, which allows consumers to find and buy ecological products. It acts as an online store and a source of knowledge for those who focus on sustainability and a healthy lifestyle. Platform aiming to meet the various needs of consumers.

The platform offers diverse product categories, from healthy food to electrical vehicles and sports accessories. There you can also find renewable energy sources. For example photovoltaics, heat pumps, infrared heating, and energy audits. Thanks to this, you can find all the necessary products that are friendly to the environment in one place.

VeloMarket is a shopping platform, which allows consumers to find and buy ecological products. It acts as an online store and a source of knowledge for those who focus on sustainability and a healthy lifestyle. Platform aiming to meet the various needs of consumers.

The platform offers diverse product categories, from healthy food to electrical vehicles and sports accessories. There you can also find renewable energy sources. For example photovoltaics, heat pumps, infrared heating, and energy audits. Thanks to this, you can find all the necessary products that are friendly to the environment in one place.

VeloBank customers also enjoy extra benefits, by default gaining access to products at a lower price. Customers can take advantage of a 3% discount on purchases on the platform. This serves as an extra incentive to use the ecological products offered by this platform. VeloMarket did a great job by combining innovative e-commerce solutions with care for the environment.

5. Spring Bank, USA

Spring Bank is a pioneer in sustainable banking from NYC. What makes this bank special is its twin focus: helping both the planet and local communities thrive.Unlike big mainstream banks, Spring Bank puts its money where its values are.

Every dollar deposited helps fund green projects and supports small businesses in underserved areas. The bank has earned its spot as one of only 17 banks in the U.S. to be certified as a B Corporation, proving its commitment to both social and environmental goals.

When it comes to green initiatives, Spring Bank doesn't just talk the talk. They offer special loan programs for solar panel installations and energy-efficient home improvements. Small business owners looking to go green can access affordable loans to make their operations more environmentally friendly. The bank's commitment to clean energy goes beyond lending. They've partnered with local solar companies to make renewable energy more accessible to New Yorkers. Their own operations run on renewable energy, and they actively work to reduce their carbon footprint in everything they do.

Every dollar deposited helps fund green projects and supports small businesses in underserved areas. The bank has earned its spot as one of only 17 banks in the U.S. to be certified as a B Corporation, proving its commitment to both social and environmental goals.

When it comes to green initiatives, Spring Bank doesn't just talk the talk. They offer special loan programs for solar panel installations and energy-efficient home improvements. Small business owners looking to go green can access affordable loans to make their operations more environmentally friendly. The bank's commitment to clean energy goes beyond lending. They've partnered with local solar companies to make renewable energy more accessible to New Yorkers. Their own operations run on renewable energy, and they actively work to reduce their carbon footprint in everything they do.

6. Aspiration, USA

Aspiration is a fintech dedicated to ethical and sustainable banking. What really makes Aspiration stand out is that they don’t fund fossil fuels or industries that harm the environment.

Most traditional banks invest your deposits in things like oil, gas, or other sectors that aren’t exactly eco-friendly. Aspiration takes a completely different approach. They ensure your money is never used to support industries contributing to climate change.

One of their flagship products is the Aspiration Spend & Save Account, which is like your regular checking and savings account but with perks designed to help you make a positive impact. For example, you can earn cash back on purchases at sustainable businesses and even plant a tree with every purchase through their “Plant Your Change” program. It’s an easy way to make a difference with your everyday spending.

Aspiration’s Green Marketplace is a carefully selected collection of eco-friendly brands and products. When you shop there, you’re supporting sustainable businesses and can earn up to 6% cash back based on your account level.

Most traditional banks invest your deposits in things like oil, gas, or other sectors that aren’t exactly eco-friendly. Aspiration takes a completely different approach. They ensure your money is never used to support industries contributing to climate change.

One of their flagship products is the Aspiration Spend & Save Account, which is like your regular checking and savings account but with perks designed to help you make a positive impact. For example, you can earn cash back on purchases at sustainable businesses and even plant a tree with every purchase through their “Plant Your Change” program. It’s an easy way to make a difference with your everyday spending.

Aspiration’s Green Marketplace is a carefully selected collection of eco-friendly brands and products. When you shop there, you’re supporting sustainable businesses and can earn up to 6% cash back based on your account level.

If you’re looking to go even greener, there’s Aspiration Plus, their premium option. It offers higher cash back, better interest rates on your savings, and cool features like automatic carbon offsets for your gas purchases. So, even if you still drive a gas-powered car, you can balance out your emissions.

One of their coolest features is the Aspiration Impact Measurement (AIM) score. It’s like a personal sustainability tracker that shows how the businesses you shop at align with environmental and social goals. You get a clear picture of how your spending habits impact the planet and can use it to make more informed choices.

And here’s the kicker: Aspiration operates on a “pay what’s fair” model—you get to decide how much to pay for their services, even if that’s $0. They’re all about accessibility and letting you choose what feels right.

Looking to build a banking tool?

Contact Ulan Software for free strategic consultation!

7. Green-Got, France

Green-Got is a French neobank and financial platform that enables users to invest in sustainable projects. They prioritize investments in renewable energy, sustainable agriculture, and other environmentally friendly projects.

Green-Got offers a range of banking products, including current accounts, savings accounts, and investment options. They also provide customers with tools and resources to track their environmental impact and make more sustainable financial decisions. For example, they offer a feature that calculates the carbon footprint of customer purchases made with their debit card.

One of the key differentiators of Green-Got is its commitment to transparency. They are open about how customer funds are invested and provide regular updates on the environmental impact of their activities. This level of transparency is rare in the banking industry and allows customers to feel confident that their money is being used for good.

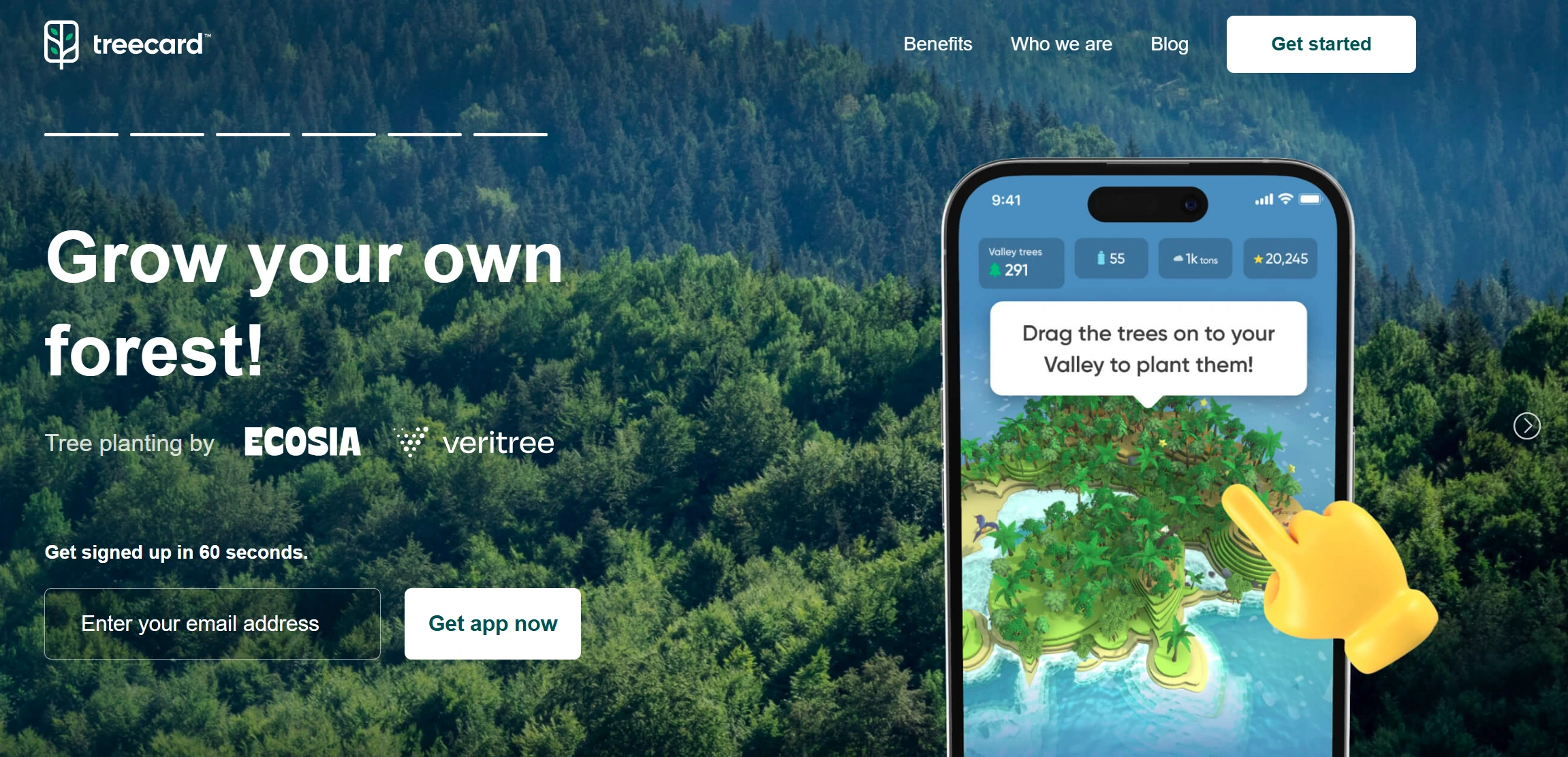

8. Treecard, United Kingdom

Treecard is a unique financial tool that combines everyday spending with environmental action. It's a debit card made from sustainable cherry wood, featuring a distinct wood grain pattern on each card.

Here's how it works: When you use your Treecard for purchases, a small fee is charged to the merchant. A significant portion of these fees is then used to fund tree-planting projects around the world. This means that simply by using your card for everyday expenses, you're directly contributing to reforestation efforts.

Here's how it works: When you use your Treecard for purchases, a small fee is charged to the merchant. A significant portion of these fees is then used to fund tree-planting projects around the world. This means that simply by using your card for everyday expenses, you're directly contributing to reforestation efforts.

You can easily track the number of trees you've helped plant through the Treecard app. This provides a tangible connection between your spending habits and the positive environmental impact you're creating.

In addition to planting trees, Treecard rewards you with vouchers for refurbished tech gadgets like iPhones, AirPods, Apple Watches, and MacBooks. The more you use your Treecard, the more vouchers you earn.

The Green Wave in Banking

The examples showcased in this article demonstrate the growing trend of green banking. These initiatives, ranging from traditional banks to innovative neobanks, are paving the way for a more sustainable financial future.

These institutions are not only reducing their own environmental impact but also empowering customers to make conscious choices with:

As environmental awareness continues to grow, we can expect to see even more innovative green banking solutions emerge. The future of banking is green, and these examples show us how it can be done.

These institutions are not only reducing their own environmental impact but also empowering customers to make conscious choices with:

- Reward and point programs

- Eco product marketplaces

- Tree planting programs

- Sustainable investments

- Carbon offsetting and tracking

- Community support

- Transparency and education

As environmental awareness continues to grow, we can expect to see even more innovative green banking solutions emerge. The future of banking is green, and these examples show us how it can be done.

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

Table of Contents:

Why green banking is a big deal for customers?

1. UmweltBank, Germany

2. FutureCard, USA

3. Tomorrow, Bank Services, Germany

4. VeloMarket by VeloBank, Poland

5. Spring Bank, USA

6. Aspiration, USA

7. Green-Got, France

8. Treecard, United Kingdom

The green wave in banking

Recommended Articles

Wed, Feb 11

How to Build a Handyman Services Marketplace

Build a handyman services marketplace in 2026. Step-by-step guide: trends, features, business models, tech stack, and expert tips for founders and CTOs.

Fri, Jan 30

Why Big Brands Are Launching Second-Hand Recommerce Platforms?

Why big brands launch second-hand recommerce platforms. Examine real data, case studies, and results from IKEA, H&M, Zara, Zalando, and Decathlon.

Mon, Jan 26

How to Build Second-Hand Marketplace Platform Like Vinted? Part III: Strategy

Discover how Vinted built a scalable second-hand marketplace by sequencing growth, monetization, trust, and expansion the right way.