Back to all Articles

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

How Banks Use Green Finance to Attract Gen Z and Millennials

Updated:

Thu, Apr 17

Reading time: 8 minutes

Banks all over the world are looking to connect their services with the needs of younger generations. But, What is the reason?

Together, Gen Z and Millennials make up a sizable share of the world's customer base. They are not only tech-savvy but also very ethically and environmentally sensitive. Banks are using eco-friendly programs to attract and keep these clients.

This data-driven article explores how banks use green finance to attract Gen Z and Millenials. We are going to explore the phenomenon based on recent research on this topic.

Together, Gen Z and Millennials make up a sizable share of the world's customer base. They are not only tech-savvy but also very ethically and environmentally sensitive. Banks are using eco-friendly programs to attract and keep these clients.

This data-driven article explores how banks use green finance to attract Gen Z and Millenials. We are going to explore the phenomenon based on recent research on this topic.

What is Green Finance?

Green Finance Definition

Green Finance -is financial support for activities and projects that promote environmental sustainability and address climate change. It includes instruments like green bonds, renewable energy loans, and investment funds targeting eco-friendly initiatives.

Gen Z and Millennials’ Relationship with Green Finance

According to a recent study, environmental consciousness significantly impacts the purchasing intentions of Gen Z and Millennials.

Approximately 64% of this demographic focus on sustainability in their financial decisions. Green finance enables them to align their consumption patterns with environmental values. These fostering a positive feedback loop between financial choices and ecological outcomes.

Another factor is future consciousness. The ability to act on long-term environmental impacts is influencing green purchasing behavior. The study reveals that individuals with high future consciousness are more likely to engage in green finance.

Gen Z and Millennials who associate sustainable financial products with social status are more likely to adopt them. Banks benefit on this by promoting green finance as a marker of social responsibility and prestige.

According to Deloitte’s 2024 Global Survey, 60% of Gen Z and Millennials report feeling worried or anxious about climate change. They are often taking actionable steps to align their choices with their values.

Around 25% of Gen Z and Millennials have finished relationships with businesses due to unsustainable practices. This demonstrates the critical importance of sustainability in influencing purchasing decisions.

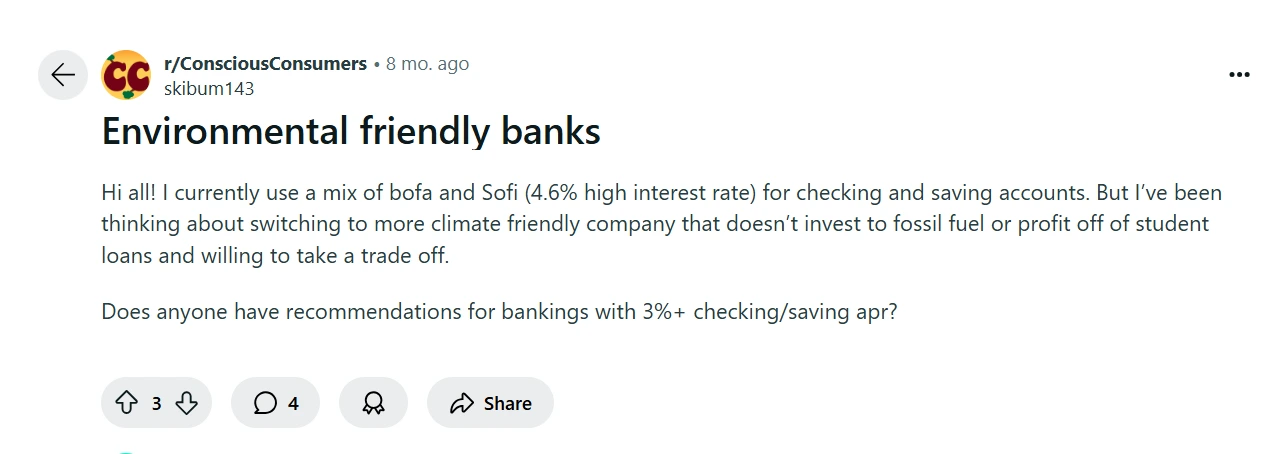

More and more Gen Z and Millennials turn to their community and peers for advice on which environmental friendly bank to choose. You can find a lot of conversations like this on Reddit.

Approximately 64% of this demographic focus on sustainability in their financial decisions. Green finance enables them to align their consumption patterns with environmental values. These fostering a positive feedback loop between financial choices and ecological outcomes.

Another factor is future consciousness. The ability to act on long-term environmental impacts is influencing green purchasing behavior. The study reveals that individuals with high future consciousness are more likely to engage in green finance.

Gen Z and Millennials who associate sustainable financial products with social status are more likely to adopt them. Banks benefit on this by promoting green finance as a marker of social responsibility and prestige.

According to Deloitte’s 2024 Global Survey, 60% of Gen Z and Millennials report feeling worried or anxious about climate change. They are often taking actionable steps to align their choices with their values.

Around 25% of Gen Z and Millennials have finished relationships with businesses due to unsustainable practices. This demonstrates the critical importance of sustainability in influencing purchasing decisions.

More and more Gen Z and Millennials turn to their community and peers for advice on which environmental friendly bank to choose. You can find a lot of conversations like this on Reddit.

Strategies Banks Use to Leverage Green Finance

1. Green Financial Products and Services

Banks are rolling out some interesting financial products. Take green bonds for example. They are used to finance renewable energy projects or climate-resilient infrastructure. Then you have green loans. These are tailored for things like buying electric cars, building energy-efficient homes, or installing solar panels.

2. Educational Campaigns on Green Finance

Banks aren’t just throwing these products out there and hoping for the best. They’re actively educating their customers. Have you seen those apps with carbon footprint trackers? They’re not just fun. This type of gamification makes it easy and rewarding to adopt greener habits. It’s like having a personal coach for your financial and environmental goals.

3. Building Eco Marketplaces

Here’s where it gets even more interesting. Some banks are going beyond partnerships and creating their own eco-marketplaces. Take Aspiration, for instance. They’ve built an entire platform offering green and sustainable products. They provide a curated selection of eco products within different categories. This move promotes sustainable consumption, builds an eco-conscious community, and generates extra profit for the Bank.

Previously, in this article, we explained Why Banks Should Focus On ESG Marketplaces for Future Growth.

Previously, in this article, we explained Why Banks Should Focus On ESG Marketplaces for Future Growth.

4. Integration with Partner Marketplaces

Of course, not every bank has its own platform. However, many collaborate with established eco marketplaces. By doing this, they can offer exclusive discounts or benefits for sustainable products. It’s a win-win: customers get a financial incentive, and banks position themselves as champions of sustainability.

5. Promotion of Green Savings and Investments

Green savings accounts and specialized investment funds are also picking up steam. The idea is simple: your deposits go toward projects like renewable energy or conservation efforts. It’s an easy way for customers to contribute to environmental goals while earning a return on their savings.

6. Bringing It All Together

What’s really smart is how banks are integrating these initiatives into a cohesive strategy. They’re not just offering green products—they’re creating ecosystems where customers can live their values. Whether it’s through personalized recommendations, gamified tools, or exclusive perks, banks are meeting Gen Z and Millennials where they are.

8 Ideas for Sustainable Banking Apps to Attract Gen Z

As Gen Z prioritizes sustainability, banks have an opportunity to engage this audience through app solutions. We gathered the most forward-thinking examples of apps and platforms that banks can build to attract the younger generation.Click edit, to change text...

1. Carbon Footprint Trackers 🌍

These apps help users check their carbon emissions based on their financial transactions. For example, the app calculates the carbon impact of purchases like flights or grocery shopping and suggests ways to offset it.

2. Green Loan Platforms 🔋

This app provides green loans tailored for specific purposes. This includes installing solar panels, purchasing electric vehicles, or making energy-efficient home improvements. Additionally, the app can have a marketplace feature. It can connect users with service providers (like solar panel installers or EV dealerships).

3. Reward and Cashback App for Green Choices 🎁

This app encourages users to make environmentally friendly decisions. By offering rewards or cashback, Banks can motivate Gen Z to make green purchases. For example, users can earn points or cashback when buying from sustainable brands. Banks can partner with sustainable merchants to create exclusive benefits.

4. Electric Vehicle (EV) Charging Map with Loyalty Program ⚡

This app supports eco-conscious banking customers while creating new revenue opportunities for banks. The application enables electric vehicle (EV) owners to find nearby charging stations, book charging slots in advance, and manage their charging sessions. Everything is in one app.

Banks can offer a subscription model and grant access to benefits. For example, priority booking for charging slots or reduced charging fees. This model creates a recurring revenue stream for banks and provides added value to conscious customers.

Features That Would Be Very Useful:

Banks can offer a subscription model and grant access to benefits. For example, priority booking for charging slots or reduced charging fees. This model creates a recurring revenue stream for banks and provides added value to conscious customers.

Features That Would Be Very Useful:

- Real-time display of available EV charging stations.

- Filters to sort stations by distance, charging speed, and pricing.

- Option to book a charging slot directly through the app.

- Rewards program where users earn points for every charging session, encouraging consistent usage.

- Redeemable points for partner discounts, cashback, or other exclusive rewards.

- Collaboration with eco-friendly partners to offer exclusive deals.

- Premium subscription options.

5. Eco Marketplace App 🛍️

Banks can build platforms that offer sustainable products and services. For example, reusable goods, electric vehicles, or solar installation services. Customers can shop while earning rewards or cashback for eco-friendly purchases.

6. Green Savings Accounts 🌱

Apps that show users how their savings contribute to green initiatives. For example, funding renewable energy projects can attract sustainability-focused savers. These platforms can also provide real-time updates on the impact of their deposits.

7. Circular Economy Platforms ♻️

These apps focus on promoting the reuse, recycling, and sharing of goods. Banks could support peer-to-peer lending platforms for items like furniture or electronics.

8. Eco-Friendly Budgeting Tools 📈

Budgeting apps tailored for sustainability-conscious users. App categorizes spending into eco-friendly and non-eco-friendly purchases, helping users make informed choices.

Looking to build a banking app?

Contact Ulan Software for free strategic consultation!

Conclusion

Young generations want their banks to care about the environment. Banks are responding with new green products. They now offer green loans and apps that measure carbon footprint.

These green banking features must be easy to use. Modern banking apps help customers support aspirations to more sustainable choices. Banks reward people for making earth-friendly choices.

To succeed, banks need to make sustainability part of everyday banking. This means creating apps that feel personal and fun to use. For example, customers can watch their green savings grow or earn points for charging their electric cars.

While building these apps, Banks need reliable technology that works at a large scale. Many banks team up with tech companies for help. Ulan Software is one company that builds ESG banking tools. We develop any type of product - from eco shopping platforms to EV charging apps.

The shift to green banking helps everyone. Banks attract younger customers who care about the planet. The banks that embrace this green technology now will lead the industry tomorrow. These changes show us the future of banking. It's digital, sustainable, and focused on making a real difference.

These green banking features must be easy to use. Modern banking apps help customers support aspirations to more sustainable choices. Banks reward people for making earth-friendly choices.

To succeed, banks need to make sustainability part of everyday banking. This means creating apps that feel personal and fun to use. For example, customers can watch their green savings grow or earn points for charging their electric cars.

While building these apps, Banks need reliable technology that works at a large scale. Many banks team up with tech companies for help. Ulan Software is one company that builds ESG banking tools. We develop any type of product - from eco shopping platforms to EV charging apps.

The shift to green banking helps everyone. Banks attract younger customers who care about the planet. The banks that embrace this green technology now will lead the industry tomorrow. These changes show us the future of banking. It's digital, sustainable, and focused on making a real difference.

Karol Andruszków

Karol is a serial entrepreneur who has successfully founded 4 startup companies. With over 11 years of experience in Banking, Financial, IT and eCommerce sector, Karol has provided expert advice to more than 500 companies across 15 countries, including Poland, the USA, the UK, and Portugal.

Table of Contents:

What is green finance?

Gen Z and Millennials’ relationship with green finance

Strategies banks use to leverage green finance

8 ideas for sustainable banking apps to attract Gen Z

Conclusion

Recommended Articles

Wed, Feb 11

How to Build a Handyman Services Marketplace

Build a handyman services marketplace in 2026. Step-by-step guide: trends, features, business models, tech stack, and expert tips for founders and CTOs.

Fri, Jan 30

Why Big Brands Are Launching Second-Hand Recommerce Platforms?

Why big brands launch second-hand recommerce platforms. Examine real data, case studies, and results from IKEA, H&M, Zara, Zalando, and Decathlon.

Mon, Jan 26

How to Build Second-Hand Marketplace Platform Like Vinted? Part III: Strategy

Discover how Vinted built a scalable second-hand marketplace by sequencing growth, monetization, trust, and expansion the right way.