Back to all Articles

Why Banks Should Focus On ESG Marketplaces for Future Growth

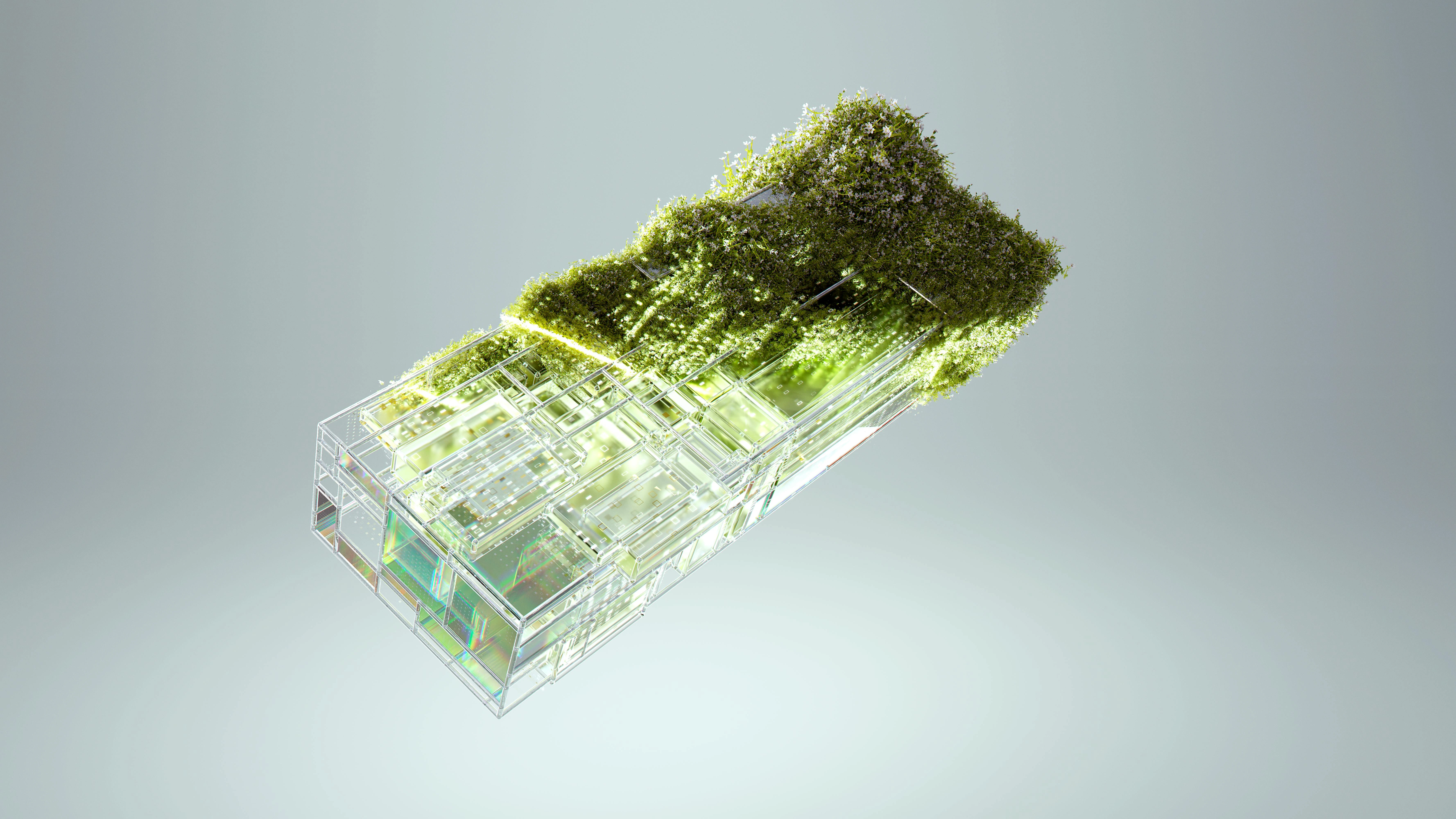

One smart move is embracing ESG marketplace. These are digital platforms that help connect banks with sustainable products, services, and data.

If you’re wondering why this matters so much, here’s the deal: ESG marketplaces aren’t about ticking boxes, they’re about future-proofing. Banks that get on board now will have the edge in a market that’s promptly shifting toward sustainable finance.

In this article, we’ll break down what ESG marketplaces are, why they’re a game-changer, and how banks can use them to drive growth and make a real impact. By the end, you’ll see why these platforms are the future of banking.

What Is an ESG Marketplace?

An ESG marketplace is a digital platform that helps banks find and put in place sustainable business solutions. It connects financial institutions with tools to meet environmental, social, and governance goals.

Banks use these platforms to offer green loans, track carbon emissions, and meet regulatory requirements. Think of it as an app store designed for sustainable banking practices.

- Centralized ESG Data Access. Banks can access ESG ratings, sustainability metrics, and reporting tools to meet regulations.

- Diverse Product Offerings. ESG marketplaces make it easy to find and integrate sustainable finance products.

- Collaboration Tools. Connecting with ESG experts, partners, and stakeholders to align strategies.

- Automation and Integration. Streamline processes and focus on what matters by automating ESG data collection and analysis

In short, ESG marketplaces simplify a bank’s journey toward sustainability. It provides them with the tools to drive impact without overcomplicating the process.

How ESG Marketplace Differ from Traditional Banking Platforms?

ESG marketplaces go beyond standard financial operations aimed to meet ESG reporting requirements. Moreover, they help integrate sustainability seamlessly into banking operations. These platforms provide real-time insights, ensuring banks have access to up-to-date metrics. As a result, banks can track and improve their ESG performance.

Collaboration is another defining feature of ESG marketplaces. They act as hubs for partnerships. Banks can connect with organizations that provide eco products or services. For example, renewable energy financing or eco-friendly investment portfolios. This collaborative approach fosters innovation and expands sustainable finance opportunities.

The Growing Importance of ESG in Banking

Why ESG Matters for Financial Institutions

Consumer and Investor Expectations for Green Banking

Read our article about How Banks Use Green Finance to Attract Gen Z and Millennials. Investors are on the same page. A report by BlackRock shows that assets under management in ESG funds surpassed $2.5 trillion in 2023, and this number is growing. Investors expect banks to fund renewable energy projects and support businesses that align with ESG values.

Meeting these expectations is no longer optional. Banks that fail to adapt risk losing their competitive edge and their customers to greener competitors.

How ESG Marketplace Helps Drive Sustainability?

Streamlining Access to Sustainable Finance Solutions 🌱

To understand what ESG marketplaces can achieve, dive into Examples of Green Banking Initiatives That Stand Out and see the impact in action.

ESG marketplaces allow banks to connect with providers of sustainable investment portfolios.

Look at Clim8 Invest platform. It offers banks curated options focused on renewable energy, clean technology, and social impact projects. Similarly, tools like GRESB (Global Real Estate Sustainability Benchmark). Banks can assess the environmental impact of their real estate lending activities by using this.

Facilitating ESG Data Integration and Transparency 📊

These platforms also enhance transparency by providing real-time access to ESG data. Banks can use this data to track their progress on carbon reduction targets. They can assess the sustainability of their investments and create detailed ESG reports for stakeholders. By integrating data tools into their operations, banks are better equipped to make informed decisions.

Encouraging Collaboration Between Stakeholders 🤝

For instance, a bank might partner with a renewable energy provider to offer financing options for solar installations. Another example is a collaboration with a fintech company to develop tools for tracking customers' carbon footprints. ESG marketplaces expand the possibilities for sustainable finance and create a broader impact.

Key Benefits of ESG Marketplace for Banks

Let’s dive into more specific benefits that ESG marketplaces bring to the table. We'll shortly describe each of them below:

Meeting ESG Regulations

Simplifying ESG Reporting

Real-Time Tracking

Audit-Ready Tools

Expanding Green Product Offerings

Eco Marketplaces for Customers

For instance, Velo Bank in Poland has launched VeloMarket. It is an eco-marketplace that connects customers with a variety of eco-friendly products. The platform offers certified food, eco-cosmetics, and sports equipment. Additionally, it provides renewable energy devices like photovoltaic panels and heat pumps. VeloMarket supports customers in making sustainable choices towards environmental responsibility.

Banks can also use ESG marketplaces to partner with renewable energy providers. Offer financing for solar panel installations or collaborate with car manufacturers to support electric vehicle loans. These partnerships are made seamless through ESG marketplace technology, which facilitates collaboration.

Cross-Industry Opportunities

Building a Stronger Brand Reputation

Strengthening Customer Loyalty

Banks seeking to attract younger generations can explore How Banks Use Eco Marketplaces to Attract Gen Z and Millennials to effectively reach eco-conscious customers.

Examples of Banks Using ESG Marketplaces

Tomorrow Bank, a digital bank in Germany, now offers a green investment platform in its mobile app. Customers can put money into eco-friendly funds that support clean energy and green technology. The app also shows how a person's spending affects the planet. Users get tools to balance out their carbon footprint. For Tomorrow Bank, caring for the environment is a key part of its mission.

Barclays Green Home Marketplace

Barclays introduced the marketplace to help homeowners find eco solutions for their properties. The platform links users to services like energy efficiency assessments, green home improvement loans, and renewable energy providers. This initiative supports sustainability in housing and helping clients lower their carbon footprints.

DBS Bank’s Marketplace

DBS Bank runs an ESG-focused marketplace on its digital platform. It connects businesses and individuals to sustainable finance options like green loans and ESG-linked bonds. The marketplace also includes tools to measure the impact of financial activities. It offers a carbon calculator to track emissions from spending. This helps clients make smarter, more sustainable decisions.

OCBC Bank’s Sustainability Marketplace

OCBC Bank launched a new Sustainability Marketplace in Singapore. This platform helps both people and businesses find green financing options. Customers can get loans for electric cars and clean energy systems. Companies can find funding for sustainable projects. Individuals can also discover green investment choices that support the environment.

For banks looking to align with ESG goals, exploring 5 Steps to Integrate an ESG Marketplace into Your Bank’s Ecosystem provides actionable strategies to get started.

Technology Challenges in Adopting ESG Marketplaces

Integration with Legacy Systems

Most banks operate on legacy systems that were never designed to accommodate the demands of ESG marketplaces. There is a lack of flexibility to integrate real-time ESG data, advanced analytics, and external APIs. A solution? Partnering with a technology provider like Ulan Software, which specializes in microservices-based architectures. Unlike monolithic systems, our modular design allows banks to integrate ESG-specific functionalities. For example, compliance tracking, real-time data ingestion, and analytics dashboards. All these without overhauling existing infrastructure.

Scalable and Resilient Platforms

Another key requirement is scalability. As ESG marketplaces grow, the volume of data and transactions will expand. This should be in mind while choosing the right marketplace engine provider. Various platforms in the market may fail under the load, leading to downtime or delays.

Making Data Actionable with Advanced Analytics

Data lies at the heart of any ESG marketplace, but simply gathering data isn’t enough—it must be actionable. Banks need tools to process and analyze ESG info in real-time, offering insights that guide decision-making. Engines with AI analytics can identify patterns in performance and ensure alignment with regulatory requirements. These capabilities allow banks to:

- Focus on investments in high-performing ESG assets.

- Adjust lending practices based on sustainability risks.

- Provide clear, actionable insights to institutional and retail users.

Such tools enable banks to offer differentiated services in the ESG space.

Cybersecurity and Data Privacy

Handling ESG data comes with heightened cybersecurity risks. Marketplaces deal with sensitive information, including corporate sustainability metrics, and financial data. Banks need platforms that ensure data is protected from breaches. Whether through encryption, multi-factor authentication, or strict access controls. At the same time, compliance with global privacy standards is crucial to building trust with users.

User Experiences is a Key

ESG marketplaces should be simple and user-friendly. Investors need tools to manage complex portfolios, while retail users seek easy ways to explore sustainable investments. Clear navigation, intuitive design, and actionable insights are essential. Platforms that focus on user experience are better at building loyalty and driving long-term engagement.

Rapid Implementation and Testing

Time-to-market is critical in the competitive ESG landscape. Leveraging pre-built modules or existing frameworks can speed up the development process. This allows banks to focus on differentiation rather than reinventing the wheel.

For banks just beginning their sustainability journey, How to Build a Banking Marketplace That Aligns with ESG Principles outlines the foundational steps to create an impactful and compliant platform.

How to Get Started with an ESG Marketplace?

1. Define the Scope and Objectives

To-Do:

- Host project discovery sessions with key stakeholders to identify your ESG goals.

- Benchmark against competitors or existing ESG marketplaces to understand market gaps.

- Define measurable success metrics (transaction volumes, user adoption rates, etc.).

2. Build the Right Technology Framework

To-Do:

- Conduct a systems audit to identify legacy technology limitations.

- Adopt a microservices-based architecture.

- Ensure cloud scalability to handle future growth and varying transaction volumes.

3. Establish Data Standards and Sources

To-Do:

- Partner with established ESG rating agencies and data providers.

- Use frameworks like GRI, SASB, or TCFD to standardize the data your marketplace will process.

- Invest in AI tools to validate, clean, and analyze incoming data, ensuring reliability and avoiding greenwashing accusations.

- Develop transparent scoring or rating systems that users can trust.

4. Pilot with a Niche Offering

To-Do:

- Choose a specific product or services to pilot.

- Partner with a few key institutional players to generate initial activity.

- Check early performance metrics and user behavior to identify areas for improvement.

5. Collaborate with External Experts

To-Do:

- Engage a technology partner with expertise in scalable platforms and marketplaces.

- Consult sustainability experts to align your marketplace with current ESG trends and regulations.

- Build partnerships with fintechs for innovative products and offerings.

6. Launch and Iterate

To-Do:

- Set up a feedback loop with early adopters to refine your offerings.

- Use analytics to track KPIs like user engagement, transaction volumes, and compliance rates.

- Expand into additional ESG asset classes or functionalities based on market demand.

Conclusion

First of all, banks must focus on building the right tech framework and establishing data standards. Starting with a clear vision, piloting niche offerings will ensure a smoother path to success.

Throughout this process, partnering with the right technology provider can speed up time-to-market.

By implementing ESG marketplaces, banks can become active drivers of sustainability. They can better engage with conscious consumers and build reputation in sustainable finance. The future lies in ESG banking marketplaces that deliver value for customers, investors, and the planet.

What is an ESG Marketplace?

How ESG Marketplace Differ from Traditional Banking Platforms?

The growing importance of ESG in banking

How ESG Marketplace helps drive sustainability?

Key benefits of ESG Marketplace for banks

Examples of banks using ESG Marketplaces

Technology challenges in adopting ESG Marketplaces

How to get started with an ESG Marketplace?

Conclusion